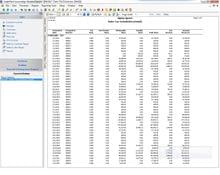

Is the language of business, and good accounting software can save you hundreds of hours at the business equivalent of Berlitz.There's no substitute for an accounting pro who knows the ins and outs of tax law, but today's desktop packages can help you with everything from routine bookkeeping to payroll, taxes, and planning. Each package also produces files that you can hand off to an accountant as needed.Small-business managers have more accounting software options than ever, including subscription Web-based options that don't require their users to install or update software. Many businesses, however-including those that need to track large inventories or client databases, and those that prefer not to entrust their data to the cloud-may be happier with a desktop tool.We looked at three general-purpose, small-business accounting packages: Acclivity AccountEdgePro 2012 (both the product and the company were previously called MYOB), Intuit QuickBooks Premier 2012, and Sage's Sage 50 Complete 2013 (the successor to Peachtree Complete). All three packages offer a solid array of tools for tracking income and expenses, invoicing, managing payroll, and creating reports.These full-featured and highly mature programs don't come cheap.

Acclivity AccountEdge Pro, at $299, is the least expensive; and prices climb if you opt to use common time-saving add-ons such as, or if you add licenses for multiple user accounts.All three are solid on the basics, but they have distinct differences in style and focus. The more you know about your accounting requirements, the more closely you'll want to look at the software you're thinking of buying.Sage 50 Complete should appeal most to people who understand the fine points of accounting and can use the product's many customization features (especially for businesses that manage inventory).Click to read our hands-on review of.QuickBooks works hard to appeal to newbies who need only the basics and might be intimidated by the level of detail and technical language exposed in the other two packages. At the same time, it also has a slew of third-party add-ons that meet specific needs and greatly expand its capabilities.Click to read our hands-on review of.AccountEdge Pro balances accessibility with a strong feature set at an affordable price. It's especially suitable for businesses that need to provide simultaneous access to multiple users.Click to read our hands-on review of.

One of the most important and also challenging aspects of running a business is keeping good accounting records, especially being able to show your income, outcome, and profit at any one time.As a start-up it's easy to become overwhelmed with all the administrative tasks you need to manage. Integrates with many popular servicesis a popular cloud-based accounting service designed specifically for small business owners.The package has plenty of features – invoicing, expense tracking, time tracking, a host of business reports, even an option to take credit card payments (for a 2.9% plus 30 cents transaction fee) – but a straightforward interface aimed at non-accountants ensures you'll be up-and-running right away.Despite the simplicity, there's real depth here. You can bill in any currency, save time by setting up recurring invoices, allow customers to pay via credit card by checking a box, and even automatically bill their credit card to keep life simple for everyone.If you need more power, the system integrates with many other services, including PayPal, MailChimp, Basecamp, WordPress, Gusto, Zendesk and more.Management hassles are kept to a minimum. You're able to access and use the system from your desktop or its free iOS and Android apps, and because it's a cloud-based system there's no need to worry about backups.If this sounds appealing, you can try FreshBooks for 30 days without using a credit card.The Lite plan gives you invoices, estimates, time tracking, expenses, plus the ability to accept online credit card payments and import expenses from your bank account. It's $15 a month, but only covers you for five clients.The Plus plan supports a more reasonable 50 clients, adds the ability to send proposals, and saves you time by providing recurring invoices and the option to automatically send payment reminders. It's decent value at $25 a month.The $50 a month Premium plan lifts the client limit to 500, and further users can each be added for $10 per month. Free trialmay have been around since the days of DOS, but the latest version is right up-to-date – it's an easy-to-use cloud-based suite for just about all your business needs.The Simple Start plan costs $25 per month, with 50% off the first 3 months, an offers a good range of basic but useful features.

Home Accounting Software

For $40 per month the Essentials plans has plenty of features: invoicing, expense tracking, as well as time tracking, manage bills, and works for up to three users. There's also the option to add either self service payroll or full service payroll for an additional fee.Just like FreshBooks, there are a pile of apps to add more features: inventory management, Shopify integration, job scheduling, and more.

These can be expensive – many services cost more than QuickBooks itself – but there are exceptions.Add GoCardless (which is available for UK customers), for instance, and you're able to set up and take regular Direct Debit payments from customers for a mere 1% transaction fee capped at £2 – and there are no sneaky setup charges or other hidden extras. QuickBooks also offers mobile apps for iOS and Android.Overall we'd usually prefer FreshBooks, but there's plenty to like about QuickBooks, too, and with free trials available it's easy to try them both. Basic plan has limitationsmight grab your attention with its low $9 per month Early plan account but look closely and limitations soon become apparent – like being restricted to sending a maximum of five invoices, entering five bills, or reconciling only 20 bank transactions.Still, if you can live with those restrictions there are some pluses here. The service offers smart expense tracking and management, optionally on your mobile with Xero's excellent app for Android and iOS. There are dozens of configurable reports, simple budgeting, and no limits at all on additional users or the accountants you might want to access the data.If the invoice, bank or billing issues are a problem then the Xero Growing plan looks like a better deal. It's a lot more money at $30 per month, but you can issue as many invoices and enter as many bills as you like.Xero offers plenty of functionality, including a handy 'convert your QuickBooks files' service to help you get started, and it's certainly easy to use. But if you don't quite need all that power, there's better value to be had elsewhere.

Most Used Accounting Software

Impressive customer supportmakes a good first impression with its clear and gimmick-free pricing. The top Sage Accounting plan offers decent value at just $25 per month.

Free Home Accounting Software Reviews

There is also a 30-day free trial.For this, you get modules to manage quotes, invoices, handle and submit VAT online, smart bank feeds and reconciliation, cash flow forecasting, some detailed reports, multiple currency support, project tracking and more, all available from your desktop or via a mobile app.All this is well presented and generally easy-to-use. If you run into trouble, detailed web help and video tutorials are only a click or two away, with the offer of “free unlimited 24/7 telephone and email support” that should help make any newbie comfortable.Sage also has a more basic offering called Accounting Start.

This doesn't include support for quotes, estimates or vendor bills, and has no cash flow forecasts, but it's only $10 per month and could be enough for small businesses. World of warcraft android download. No Android mobile appChoosing an accounting package often involves browsing a complicated comparison table, looking for hidden catches and trying to figure out which is the best product for you.avoids all that with a single $19.95 a month plan, or $199 annually, which delivers just about everything you're likely to need.Kashoo shines when it comes to multi-currency support, an important feature for today’s global economy. It also supports credit card transactions for all the major carriers – Amex, Visa and Mastercard – at a competitive 2.9% plus 0.30 cents transaction fee.You also benefit from unlimited invoices and connections to over 5,000 financial institutions to reconcile accounts online.

We liked the uncluttered interface of this product, and the dashboard that provides a good summary of your current financial situation at a glance.Kashoo also offers customer support across the gamut of email, phone, live chat and social media – this company will even respond to an old-fashioned letter! One current shortcoming to note, however, is that there is only a mobile app for iOS, leaving Android users out in the cold for the time being. Kashoo offers a 14-day trial for those looking to test the service out.Also consider these accounting software platformsis a simple solution for the self-employed and small businesses, who don't need all the bells and whistles, or cost, of full-on accounting software packages. It still comes packed with essential features, but keeps things simple and comes in at a lower price than other platforms. It's also scalable, so if you find you do need more, it's possible to purchase additional plans, features, and extensions to cover your requirements.is a solution for tracking expenses rather than full accounts, but could be very useful to have in addition to some of the platforms above, not least because not all of them can track expenses with such dedication.

This is especially the case for small businesses with a number of employees, where expenses might not always be reported or submitted properly, even though there is a potential tax deductible saving for the business for doing so.is specifically designed to provide a cloud accounting and finance solution for Salesforce. This means full tracking of customer accounts across multiple workbooks, as well as recording assets, payables, collections, and more. This makes Financial Force less of a simple accounting platform and takes it into the realm of enterprise resource planning (ERP), and it is potentially very useful for those businesses already running Salesforce software.is another software platform aimed more at small and medium businesses, offering an ERP that brings together sales, accounting, inventory, project and time management into a single dashboard.

However, despite these diverse elements, the accounting feature is fully developed, and includes automated billing, along with instant reports on profit/loss, and the balance sheet.is another big ERM platform and bills itself as the only end-to-end solution to automate the entire global payables operation in a unified cloud platform. At this point we're talking about a platform that goes well beyond accounting and into direct tax compliance and financial risk assessment, clearly intended for Fortune 500 companies that need full audit trails on a global scale, which is probably why Amazon is advertised as a customer. We’ve also rounded up all the.